Award-winning PDF software

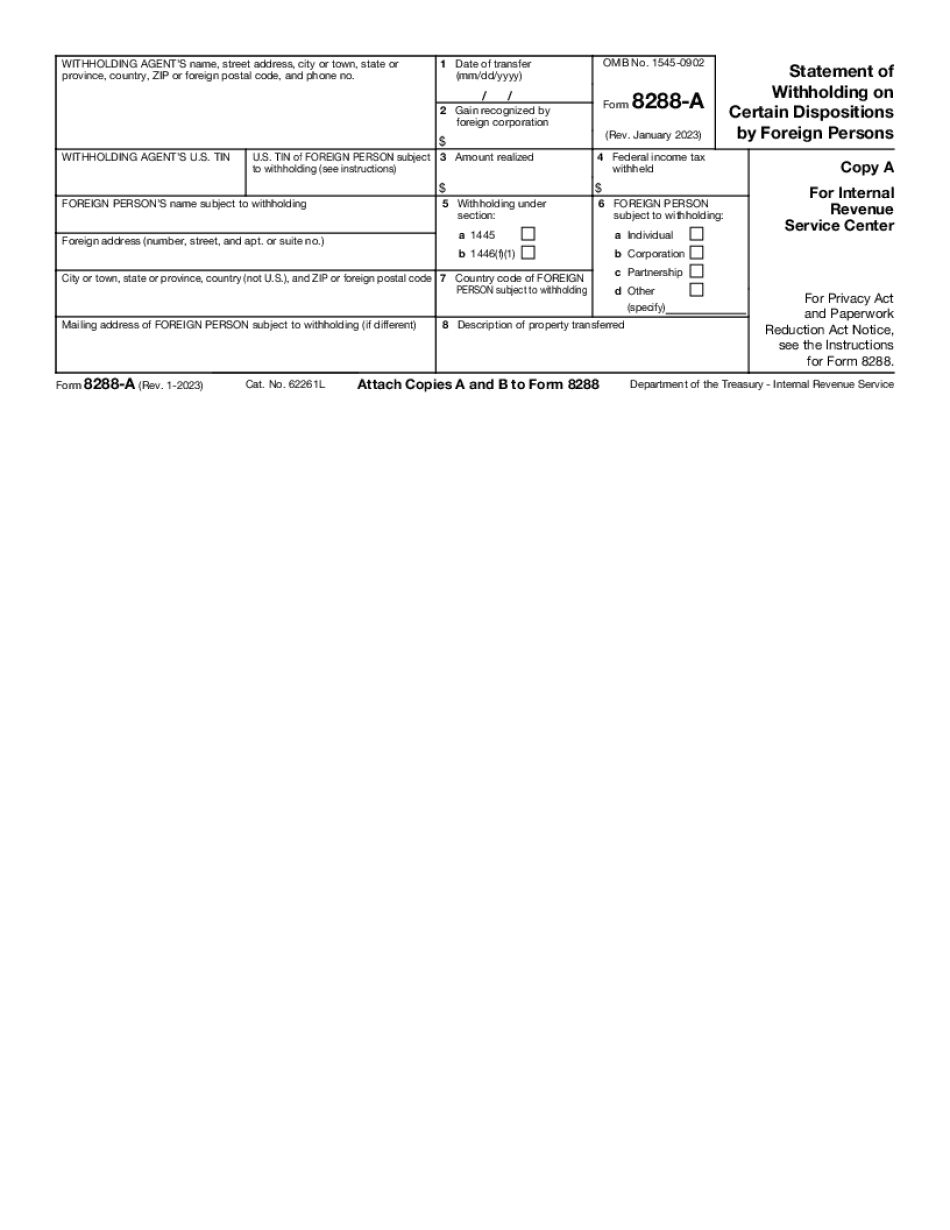

Form 8288-A MS: What You Should Know

Forms 5471 And 5472 How Will I Know If My Foreign Property Is Being Sold In The US? Oct 4, 2025 — Foreign entities are required to file a form with the Treasury Dept. when they are selling their properties overseas. This tax form is known as Form 5471 or 5472. It is for withholding taxes on property that has been held in the US or foreign currency for more than 10 years. This form is required for certain properties in certain regions of the US: In the event of sales in the US, the owner must provide us (the US Treasury) with a signed declaration, which is required to establish that the property has been held for more than 10 years in one of the five foreign countries listed on the Form 5471 or 5472. What Does Form 8288/5472 Mean? Sep 28, 2025 — This form, issued by the Treasury Department in 2014, may be filed by any person in order to obtain a foreign income tax withholding payment exemption that will allow foreign investors in the US to make tax-free payments on all their foreign property holdings in the US Form 8288/5472 is required for all sales or dispositions of US real estate property interests to non-resident foreign persons outside the US, regardless of the date of purchase, possession, or disposal, regardless of which country the property was acquired and for no reason specified in the ownership report. How do I File Form 8288/5472 When Disposing Of Property In The USA? Sep 28, 2025 — Anyone living in the USA or foreign country should file a Form 8288 form with the US Treasury Department once every tax year. Form 8288 is used to withhold US personal gross domestic income taxes from foreign investors When are the Foreign Transfer Taxes Due? Sep 28, 2025 — Once a year, the foreign personal property taxes for all real property acquisitions from a “foreign person” are due on the last day of the tax year. What is the Foreign Personal Property Income Exclusion? Sep 28, 2025 — The Foreign Personal Property Income Exclusion allows foreign investors in the US to exclude their US domestic income taxes when transferring property to a foreign individual or corporation.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8288-A MS, keep away from glitches and furnish it inside a timely method:

How to complete A Form 8288-A MS?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8288-A MS aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8288-A MS from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.