Award-winning PDF software

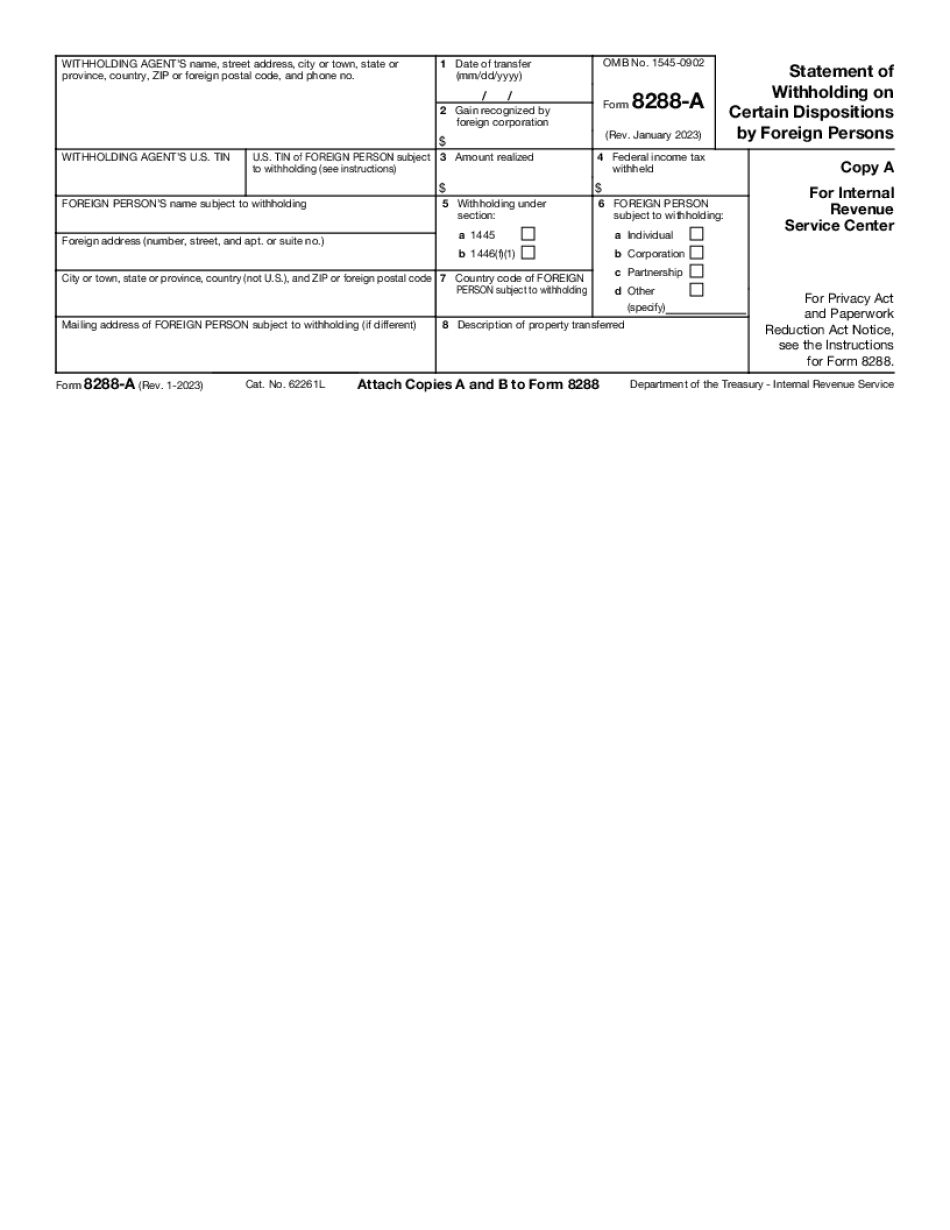

Form 8288-A for Santa Clara California: What You Should Know

F-8348, (Rev. June 11, 2010) — IRS The California Real Property Assessment Reform Act of the California Legislature, which was signed into law by the Governor on May 31, 2006, provides for the administration of local assessments of real property by property owners that is sold, conveyed, leased, or otherwise disposed of by a person that held a right to the property prior to the enactment of the Real Property Assessment Reform Act and that owns more than one million dollars' worth of tax-exempt real property. As of March 17, 2008, foreign persons have been assessed more than 5 billion worth of California real property in connection with transactions in which the property was sold, transferred, leased, or otherwise disposed of by a person that held a right to the property prior to the enactment of this statute. C.F.R. 6.01-8(c)(1). In order to increase awareness of this issue, the Office of Legislative Research (OR) has issued an instructional brochure on this issue: Property Assessments for Foreign Persons in California. F.S. 1052.1. General provisions The Legislature finds and declares that the real property laws of the State of California as applied to the sale, conveyance, lease, or other dispositions of real property by United States persons do not reflect the real property laws of the United States, with respect to the administration of local assessments of real property in California. The real property laws of the State of California, whether administered by the California Department of Finance or by local property assessors, shall apply only to the United States persons who are subject to, and are in compliance with, the real property laws of the State of California. C.F.R. Sections 1.12, 1.45, 1.61, 1.62, and 1.65. Title 24. Housing and Community Development. Chapter 6, Subchapter C, Article 23, Part A, Chapter 9, Subchapter A. Section 10001. Tax exemption for foreign persons.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8288-A for Santa Clara California, keep away from glitches and furnish it inside a timely method:

How to complete A Form 8288-A for Santa Clara California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8288-A for Santa Clara California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8288-A for Santa Clara California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.