Award-winning PDF software

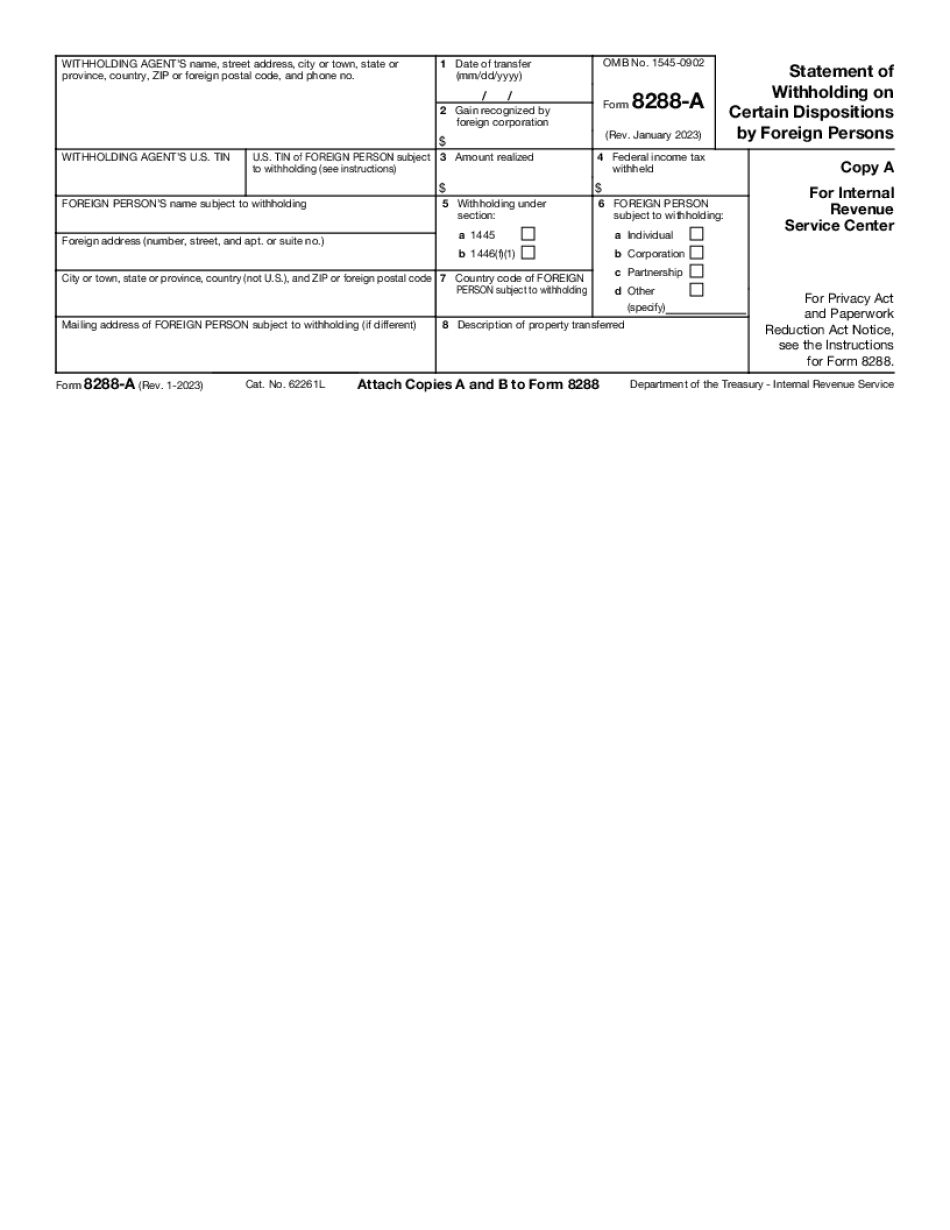

Form 8288-A for Waterbury Connecticut: What You Should Know

Comment Section on Form 1040-ES, Statement of Information Aug 25, 2025 — Comment on Form 1040-ES, Statement of Information, which is used to report the income of nonresident aliens living in the United States for which they withhold tax. Reply to Comment: Form 2687, Statement of Nonresident Alien Income, which is a statement of reported foreign source income of all nonresident aliens, including foreign sources earned at source by U.S. corporations. Aug 22, 2025 — Comment on Form 1040, Income Tax Return for Tax Years Beginning in 2001, for taxpayers with a foreign source earned at source income that is included in the foreign earned income exclusion. Comment Section on Form 8971, Statement of Withheld Employee Exclusion. AGENCY: U.S. Department of Labor, Wage & Hour Division (WHO), Wage & Hour Offices, 1900 Constitution Avenue S., SE., Room 1204, Washington DC 20210. Comment Section on Form 8971, Statement of Withheld Employee Exclusion. AGENCY: U.S. Department of Labor, Wage & Hour Division (WHO), Wage & Hour Offices, 1900 Constitution Avenue S., SE., Room 1204, Washington DC 20210. Aug 19, 2025 -- Comment on Form 1520, Withholding Certificate for Certain Exemptions and Deductions — WHO Wage & Hour Offices. AGENCY: U.S. Department of Labor, Wage & Hour Division (WHO), Wage and Hour Offices, 1900 Constitution Avenue S., SE., Room 1204, Washington DC 20210. Aug 17, 2025 — Respondent's position in reply to [Form] 4549, Statement of Information on Tax Withholding for Filing the Return of a Qualified Offshore Individual, filed by plaintiff, with respect to the withholding of certain taxes by a foreign person with respect to property acquired through and from the disposition by such foreign person of a United States real property interest in its own country. Question 1. Are respondents claiming that the information described in the second paragraph of section 530A's form is not required to be filed with the return if it is in the form of an invoice? Answer: No. Such evidence may be submitted to the IRS on Form 4549 or to the tax return preparer, for additional disclosure and verification purposes. As the Form 4549 is not an invoice, it cannot be used as evidence of any such withheld tax.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8288-A for Waterbury Connecticut, keep away from glitches and furnish it inside a timely method:

How to complete A Form 8288-A for Waterbury Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8288-A for Waterbury Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8288-A for Waterbury Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.