Award-winning PDF software

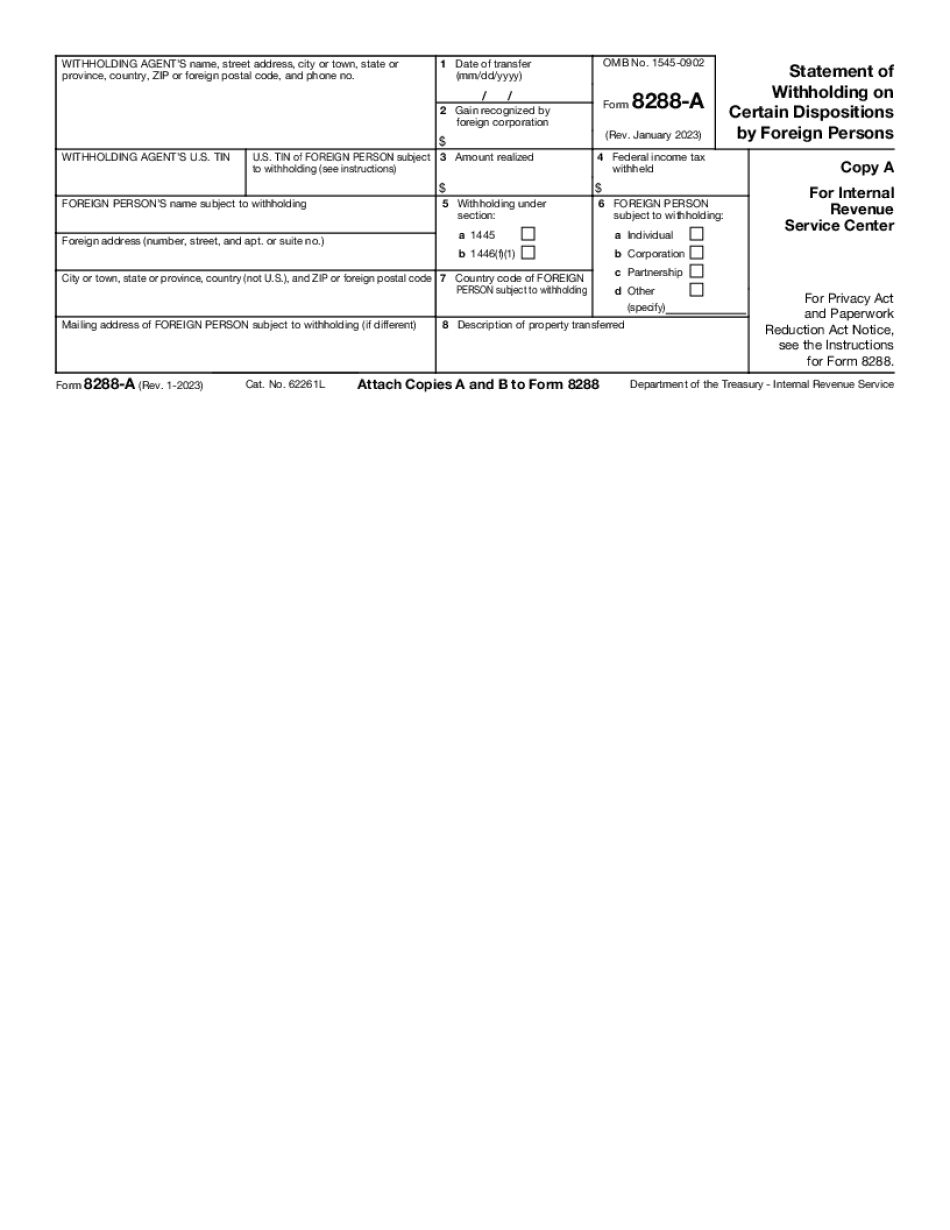

Form 8288-A for Surprise Arizona: What You Should Know

Form 709, Taxpayer Identification Number to Report Transfers between the U.S. for Property Transfers (Form 720) Oct 26, 2025 — Fill this form and one for your tax return. When completed, you must upload your tax return to IRS. Tax filers in Canada using the Form 720 must also make sure their filing status is in the correct category. Form 720, Transfers between the United States for Property Transfers (Form 720) Form 720-A, Transfers under the Foreign Investor Direct Investment Plan (Form 720-B, Form 760) July 22, 2025 — Fill this forms to make sure you comply with the requirements of the Foreign Corrupt Practices Act (CPA) if you make a significant amount of money from investments in U.S. assets (including real and intangible property). Form 7507; Form 7203, Transfers Between U.S. and Puerto Rico (Form 7507) Jan 18, 2025 — For tax years 2025 through 2016, form 7203 and the Form 7507 must be filed with a paper return. For subsequent tax years, you may also file a paper form. Form 7501, Transfers Between the United States for Property Transfers and Related Business Transaction (Form 7507) Form 7609A, Statement of Sale, Transferee, or Assignment of Property Interests, if you Are a Small Business Sep 6, 2025 — Do the Form 7609A when you sell, trade, transfer, or assign a U.S. real or intangible property interest (as defined in section 1221a(5)(B)). The sale, trade, transfer, or assignment must be reported on line 5c of Form 709 or Form 720 (as applicable) to the extent that your gross revenue from that disposition exceeds 500,000. Form 7609-A, Statement of Purchase, Sales, or Lease of Property Interests; Exemption From Filing of Form 709 or Form 720; and Reporting of Income from Sale, Sales, or Lease of U.S. Real and Intangible Property Interests (Form 7609A) Sep 6, 2025 — Form 7059 is used to get information from the seller that he or she is a U.S. person. Be sure you know the legal definition of a U.S. person to avoid problems with that form.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8288-A for Surprise Arizona, keep away from glitches and furnish it inside a timely method:

How to complete A Form 8288-A for Surprise Arizona?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8288-A for Surprise Arizona aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8288-A for Surprise Arizona from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.