Award-winning PDF software

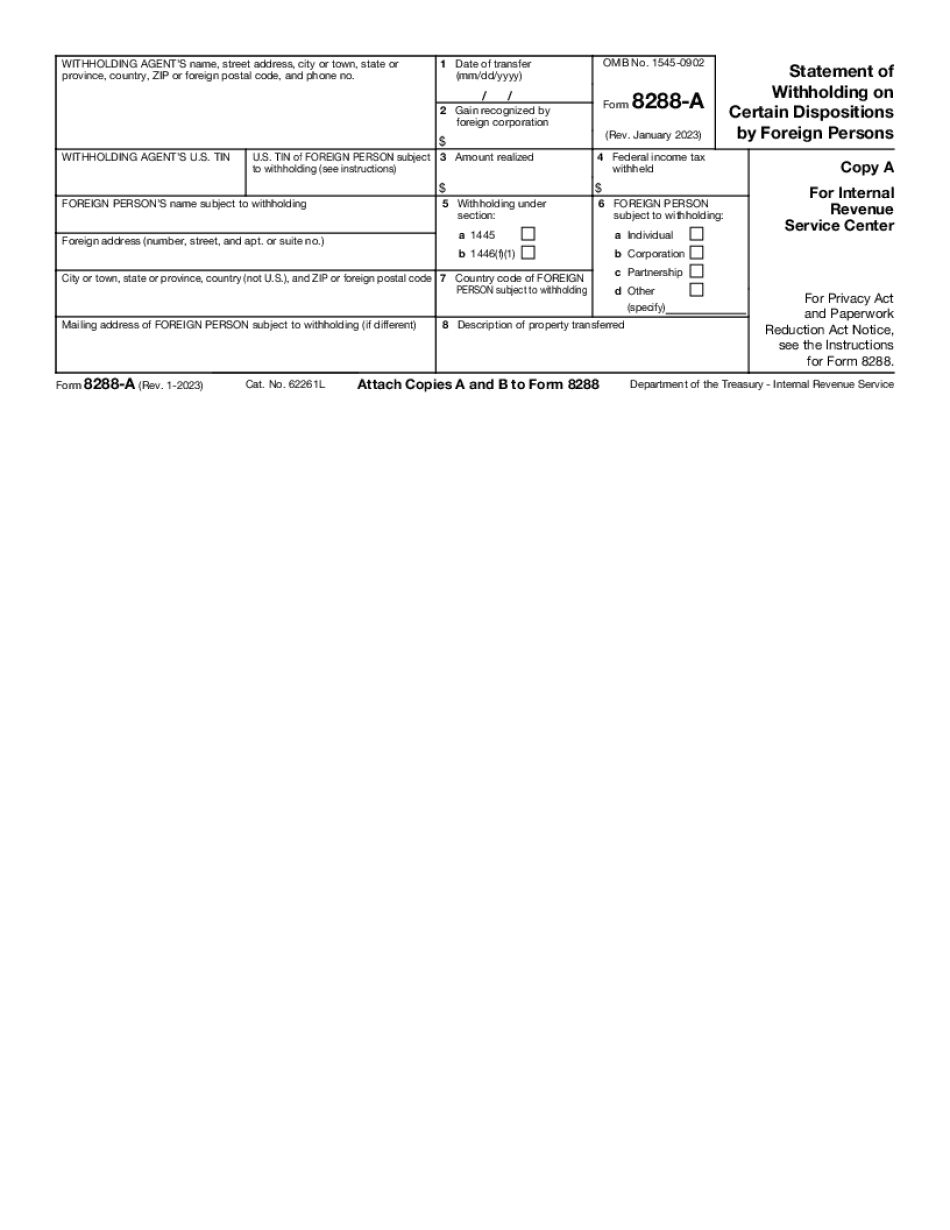

Coral Springs FloridA Form 8288-A: What You Should Know

Fax: Fraudulent Tax Return Filing: The IRS is always looking for people who file fraudulent returns. That is why they have so many forms. If people can be charged, fined or imprisoned, I don't believe they are going to file any returns. How to Prepare For a Potential Tax Event If you receive a Letter or Email from the IRS or State Taxes Divisions, it is important that you read them to understand the consequences for the fraudulent return. To prepare for your potential IRS assessment or criminal prosecution in the Tax Court, the following is a summary of important facts from the IRS Manual 5.3, Tax Conviction Procedures: You are required to file a criminal tax return by April 1st if... You are convicted of a tax crime (i.e., knowingly and willfully failing to pay any tax that was due or underpaid; or knowingly and willfully causing the IRS to apply to a court for a tax lien against you, your property, or income which was not due or underpaid) or are convicted of aiding or abetting a tax crime. If you are criminally convicted you will be convicted at the judgment of a jury, and an appeal will be filed by you. You will receive a criminal conviction summary in the mail, so you will need to contact the court or IRS to make sure the judgment has already been entered on your criminal record and/or the appeal has been filed. If you are sentenced to imprisonment or paid a fine, the judge will inform you of the judgment from the court. If you received an administrative summons, you should pay the IRS by April 1. If, however, you were sentenced to imprisonment or served a fine, and you are still unable to pay the debt, you cannot do so (because you violated your probation), no matter your financial situation. If you served a prison sentence, you will not be allowed to vote or serve on a jury before you are allowed to pay the prison sentence. You are required to file a criminal tax return by April 1st or pay the criminal tax judgment in your criminal record on April 1st. You can obtain a free copy of the IRS Manual 5.3 (Vol. 25), Federal Criminal Tax Conviction Information, from the IRS website. If you are convicted under state tax laws (i.e.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Coral Springs FloridA Form 8288-A, keep away from glitches and furnish it inside a timely method:

How to complete a Coral Springs FloridA Form 8288-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Coral Springs FloridA Form 8288-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Coral Springs FloridA Form 8288-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.