Award-winning PDF software

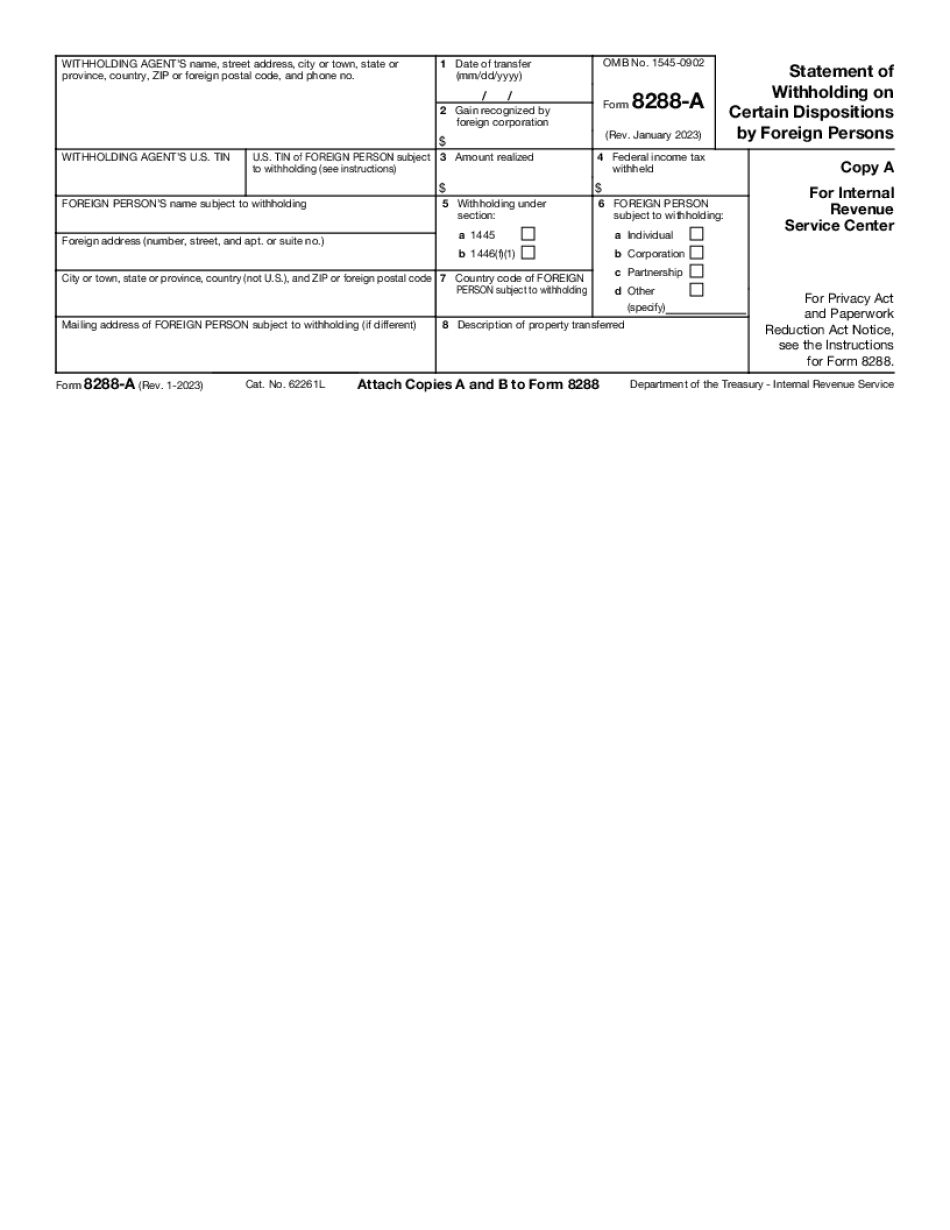

About form 8288-a, statement of withholding on dispositions by

For more information and/or to see a list of all recent Form 8288-A filings or to order the current year's Form 8288-A, click here .

form 8288-a (rev. april ) - internal revenue service

For information on early withholding, see Pub. 544. Complete and attach Form. 8288-A to the IRS or to the state or local taxing authority you deducted tax from, and submit the required document(s). You must mail this form to: For more information on requesting an Early Refund, see You may also be able to request and receive a refund of tax withheld and paid before you filed your tax return. For more information, see the following topics: If you cannot use the online filing system to calculate your withholding, ask the person who issued you your IRS Form 1040 to help you calculate your payment. Ask the person who issued you Form 1040 whether it is available online. If so, ask that person to calculate a payment code on the return. To do this, locate your check or other payment in the envelope, and: You also should ask for an indication whether you.

Form 8288-a statement of withholding on dispositions by foreign

If you have any credits, deduct them on Line 6 of Form 1040 Schedule A if your filing status is married filing jointly, and you can get a deduction. File Schedule D to report all your net capital gain. Use Form 1040 or Schedule D (Form 1040) to report the gross amount you made in excess of your basis in the property. If you have more than one taxpayer (or two or more taxpayers at the same address) and the income is 250,000 or less, you must designate which is the primary taxpayer. Otherwise, you would be treated like a nonresident alien, which is prohibited under IRC 6251. On Form 8832 on line 21, list the entire taxable year in which you made the qualifying transfer with the exclusion of the prior year. To receive special treatment under IRC 6721 or IRC 6676A, you may elect to designate the first taxpayer as the.

Form 8288, us withholding tax return for dispositions by foreign

Document ID: : E85473778 Income Tax Return Submission : 2 2 2 2 2017 Income Tax Return Submission : 2 2 2 2 2017 Income Tax Return Submission : 2 2 2 2 2017 Income Tax Return Submission : 2 2 2 2 In: CIT : A-8668EJ-M4 _____. _____. _____. _____. In: ID : E8505707-M3 _____. _____. _____. _____.

Understanding how firpta works - mila abosch, esq.

General Information The following information must be included on Form 8288. a.) The name of the taxpayer. b.) A description of the real estate and other personal property or real estate interests purchased, if any. c.) The date of the transfer. Note: If the seller received the property in exchange for another real estate interest, that “other real estate interest” is generally not included in the 600,000 thresholds (such as a deed-in-lieu-of-sale to acquire another parcel of real estate). If the actual purchase price of the property is 100,000 or more, the cash payment received through the sale of the property is generally not included in the 600,000 thresholds, as there is no other cash income related to the property's transfer. d.) If the seller is the buyer for an interest acquired within the previous 30 days, or the seller has not yet met with the buyer, it should appear on line.